0 item

What are you waiting for? Start your free trial!

14 FREE Days of Trade Alerts - CLICK HERE This is a sample Daily Wrap.

Log in to your active subscriber account and select today’s date on the calendar to view today’s Daily Wrap.

LOG IN

CARNIVORE IS EATING THE TRADING WORLD

HALL OF FAME TRADERS LIVE HERE

THE LION NOW RULES THE STREET!!!

2022 YTD***

——————————–

WHAT HAPPENED TODAY?

DOW was UP 827

NASDAQ was UP +232

——————————–

——————————–

HEAT MAP

——————————–

——————————–

HEADLINES

CPI Print was hot – market crashes at open – we cover the shorts – then we make a run to the short side again, take a small loss, and flip to the long side of the ledge with a buy on 5 high octane stocks most of the new Carnivores have never heard of before, so welcome to the party when we go long guys – and the high octane super huge monstrous high quality fat liquid growth stocks that Carnivores play in. Market rebounds off the -500 DOW print in the AM and runs up +644 within the first two hours, maybe some short covering, but looks to us like the selling is exhausted for now.

It appears that the UK has had enough of our Fed and is stepping in hard to protect its currency now.

This is good. Other central banks likely to do the same thing until the Fed begins to act rationally.

——————————–

——————————–

BULL/BEAR GAUGE

We just moved our Bull Bear Gauge to 40 for October

A reading 50 to 100 is bullish. 50 to 0 is bearish. 100 being the most bullish and 0 being the most bearish.

This is our outlook for the next 30 days for the overall stock market.

Year-end DOW forecast: 40,000

Year-end NASDAQ forecast: 17,000

——————————–

CARNIVORE POSITIONS***

Current Live Positions and Data

Yellow Highlighted = 30 days or less to Target Date

Green Highlight = Has Traded Above Target

—————————

Our Weightings***

Colors have no meaning

——————-

Position Summary***

We have a total of 6 positions

0 Short Positions

At/In the Money: 5

Out of the Money: 1

Biggest Unrealized Gain: SPXU +2.64%

Biggest Unrealized Loss: WOLF -0.60%

No Options No Micro Caps No Penny Stocks No Weird Stuff

————————-

TRADES WE DID TODAY

SALES

We covered all our short positions by selling the inverse ETF’s and buying in our two short positions

Our profit was big – took us to $880,000***

We then finished around $887,000 after putting on the long stocks and one long DOW ETF

SPXU

TECS

SQQQ

UVXY

PTON

PYPL

*Partial Sales – We continue to hold some of the position.

**From initial buy trigger

NEW BUYS

MDB

MongoDB, Inc. provides general purpose database platform worldwide. The company offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB. It also provides professional services comprising consulting and training. The company was formerly known as 10gen, Inc. and changed its name to MongoDB, Inc. in August 2013. MongoDB, Inc. was incorporated in 2007 and is headquartered in New York, New York.

MNDY

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, and internationally. It provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools. The company also offers product solutions for marketing, CRM, project management, software development, and other fields; and business development, presale, and customer success services. It serves organizations, educational or government institution, and distinct business unit of an organization. The company was formerly known as DaPulse Labs Ltd. and changed its name to monday.com Ltd. in November 2017. monday.com Ltd. was incorporated in 2012 and is headquartered in Tel Aviv-Yafo, Israel.

NOW

ServiceNow, Inc. provides enterprise cloud computing solutions that defines, structures, consolidates, manages, and automates services for enterprises worldwide. It operates the Now platform for workflow automation, artificial intelligence, machine learning, robotic process automation, performance analytics, electronic service catalogs and portals, configuration management systems, data benchmarking, encryption, and collaboration and development tools. The company also provides information technology (IT) service management applications; IT service management product suite for enterprise’s employees, customers, and partners; IT business management product suite; IT operations management product that connects a customer’s physical and cloud-based IT infrastructure; IT Asset Management to automate IT asset lifecycles; and security operations that connects with internal and third party. In addition, it offers governance, risk, and compliance product to manage risk and resilience; human resources, legal, and workplace service delivery products; safe workplace applications; customer service management product; and field service management applications. Further, it provides App Engine product; IntegrationHub enables application to extend workflows; and professional, industry solutions, and customer support services. It serves government, financial services, healthcare, telecommunications, manufacturing, IT services, technology, oil and gas, education, and consumer products through direct sales team and resale partners. It has a strategic partnership with Celonis to help customers identify and prioritize processes that are suitable for automation. The company was formerly known as Service-now.com and changed its name to ServiceNow, Inc. in May 2012. The company was founded in 2004 and is headquartered in Santa Clara, California.

TEAM

Atlassian Corporation Plc, through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide. Its products include Jira Software and Jira Work Management, a workflow management system for teams to plan, track, collaborate, and manage work, and projects; Jira Service Management, a service desk product for creating and managing service experiences for various service team providers, including IT, legal, and HR teams; Jira Align for enterprise organizations to build and manage a master plan that maps strategic projects to the various work streams required to deliver them; and Opsgenie, an incident management tool that enables IT teams to plan for and respond to service disruptions. The company also provides Confluence, a social and flexible content collaboration platform used to create, share, organize, and discuss projects; and Trello, a collaboration and organization product that captures and adds structure to fluid, fast-forming work for teams. In addition, it offers Bitbucket, a code management and collaboration product for teams using distributed version control systems; Atlassian Access, an enterprise-wide product for enhanced security and centralized administration that works across every Atlassian cloud product used, including Jira, Jira Service Management, Confluence, Trello, and Bitbucket; and various other products, such as Atlassian cloud apps, Bamboo, Crowd, Crucible, Fisheye, Halp, Sourcetree, and Statuspage. Atlassian Corporation Plc was founded in 2002 and is headquartered in Sydney, Australia.

WOLF

Wolfspeed, Inc. operates as a powerhouse semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies Europe, China, the United States, Japan, South Korea, and internationally. It offers silicon carbide and GaN materials, including silicon carbide bare wafers, epitaxial wafers, and GaN epitaxial layers on silicon carbide wafers to manufacture products for RF, power, and other applications. The company also provides power devices, such as silicon carbide Schottky diodes, metal oxide semiconductor field effect transistors (MOSFETs), and power modules for customers and distributors to use in applications, including electric vehicles comprising charging infrastructure, server power supplies, solar inverters, uninterruptible power supplies, industrial power supplies, and other applications. In addition, it offers RF devices comprising GaN-based die, high-electron mobility transistors, monolithic microwave integrated circuits, and laterally diffused MOSFET power transistors for telecommunications infrastructure, military, and other commercial applications. The company was formerly known as Cree, Inc. and changed its name to Wolfspeed, Inc. in October 2021. Wolfspeed, Inc. was founded in 1987 and is headquartered in Durham, North Carolina.

NEW SHORT SALES/POSITIONS

None

For price entries and targets and time frames see above positions box or the charts below in the chart section.

——————————–

——————————–

COMMENTARY SECTION

Carnivore Portfolio*** Stats

Starting Capital + Contributions $242,773***

We have around $+7,612 in net unrealized gains/losses

We have +$587,714 in net realized gains/losses YTD

Carnivore Portfolio*** Net Value = $887,048

We have $0 margin/debt

$61,000 cash

Carnivore YTD = +265.38%***

———————

THE TRADING DAY

Nice negative reaction down – we will likely cover ASAP on this -500 DOW print and go to cash and wait to see what to do next.

MORNING SESSION

We tried probing to the short side again after a small rally and the indicators rolled over, but then they reversed on us hard, we took the loss on SPXU quickly and went long 5 high octane stocks that we like when we’re seeing a wicked fast move to the long side.

High quality highly liquid heavy beta stocks that are real companies.

No point in going with bullshit low quality crap – own the best and if this is a trade or just a turn, they’ll do what they’re supposed to do for us and going in an out of these stocks doesn’t have any friction – its fast and easy and they behave right.

AFTERNOON SESSION

We make the turn and we’re DOW +604 and NASDAQ +176.

Hey – we’re in some weird psychotic market space here right now.

Around 1:00 PM w see that the “dish” that the DOW is making, in this high level consolidation for the day, is coming to a head – if we get a few more ticks to the upside, it will surpass the previous high set a few hours ago – and that would be a technical breakout to the upside. Then it occurs to me that the shorts probably have some stops in around +750 on the DOW – I know I would – so I realize that we are very close to having those triggered. And when they trigger the stops – the shorts will be buying in size and like maniacs and could set off a fire storm to the upside on this market. We’re clearing 30,000 on the DOW right now, so that’s a key benchmark also.

We hit UDOW, a 3x leveraged ETF on the DOW stocks.

$107,000 and then add to it up 50 cents.

Now the DOW is up +820 – its happening it appears.

I’m talking with the boys and we realize that there has been so much negative for so long now, that it will only take one Fed governor to say something like, “We need to pause” in order for the market to shoot up to the upside.

We are almost fully invested now, with $61,000 in cash – the rest is long.

Now we’re back down below 30,000 on the DOW but hovering around that 30,000 number – the war is on.

It just feels like this market wants to go up 1,100 points today.

TRUE FREEDOM!!!

OK!!!

Trading Done for the Day!!!

——————–

COMMENTARY

MARKET ACTION TODAY

TODAY’S TRADING ACTION

The fact that the market held up today is really strange given the economic data and the fact that for sure we’re about to see another 75 bps move by the Fed.

We’re assessing what this means and will have more for you tomorrow.

As of right now, we’re at $887,048, a new high on the Carnivore Portfolio*** for the year.

Up around 15% for the month and +265% for 2022.

We didn’t believe that the rally was real early in the AM, took a probe for the short side again after closing things out at $880,000 and took a quick loss on that SPXU probe when the market went up even more.

So we flipped to the long side when the DOW was up around +550 – and up it went to over +800 on the day and stuck.

What tomorrow brings to us – only the Universe knows.

We will talk to you in the AM

We’ve got some work to do here tonight.

——————

Stay Frosty

Dutch

————————-

TRADER Z – ACTUAL REAL LIFE LIVING MARKET WIZARD

None of the below is to be construed as investment advice.

————

TOMORROW’S STRATEGY

We will talk to you in the AM

Today was clearly something we didn’t expect – the rally that is.

But like water, we flowed with it and so far so good.

Steady as she goes, Captain!

True Freedom is bad ass.

It’s worth the hard work.

——————-

BRILLIANT CHART SET UPS

This section is dedicated to showing you the best chart setups we see out there today.

PAY ATTENTION HERE!

I don’t know if you’ve noticed, but these are really good. High percentage of what you see here go up the next day, and its from here that we often pick off our next day buys.

These are generated by our combined systems approach – which we call Vector Nostradamus.

In general, these have high Relative Strength ratings, are in highly rated groups that are performing well relative to other sectors, have over $300 million in market cap, are liquid and reporting on a major exchange.

Our focus is to bring high quality stocks to the table that any pension plan or fiduciary could trade in and get approved.

LNG

MTDR

——————————–

BELOW YOU WILL FIND MORE RESOURCES

BRILLIANT CHART SET UPS OUR SYSTEMS ARE SHOWING US

SECTORS WE LIKE RIGHT NOW

ADDITIONAL EDUCATIONAL BRIEFS

————————-

SECTOR CALLS

We like biotech and shorts on the overall market until it adjusts to a reasonable valuation. The overall market is technically in a bear market and getting deeper into it as he economy slows and the Fed is constrictive in its policy. This latest leg down has been brutal and there may be more pain to come before the market bottoms and we can advance again. There will be rips to the upside when the market gets oversold or to suck in more money, like it breathes oxygen, on the way down. We call these “sucker pops”, where it pops up and goes green, giving the “buy on dippers” hope, sucks in new capital, only to slam people back down to the mat in a loss position in short order.

————————

CARNIVORES OFFERINGS

SWING TRADES

OPTIONS IDEAS

BRILLIANT BREAK OUT SETUPS

LONG TERM PICKS

MACRO ECONOMIC ANALYSIS

TECHNICAL ANALYSIS

SECTOR ANALYSIS/SECTOR CALLS

“These guys must be crazy for doing all this work every day for such a low fee.” – Wall Street

——————————–

——————————–

CHARTS

NEW POSITIONS TODAY

Stocks in this section are NEW as of today and were bought in the Carnivore Portfolio***

The charts closest to the top are the latest stocks we have bought, the ones at the bottom are the oldest we’re holding in the Portfolio***

MDB

TEAM

NOW

MNDY

WOLF

UDOW

———————-

EXISTING POSITIONS

N/A

———–

—————————–

UNTIL TOMORROW, CARNIVORES!

DUTCH

——————

OUR SYSTEMS AND METHODS

An Explanation

For the new Carnivores, we use two systems here that work together. Vector Nostradamus is a complex set of fundamental and technical systems that finds what’s working in any market environment. It finds stocks that often are under the radar of most average investors, and it has a bias towards growth and high margins and liquidity and quality. The set of stocks it selects are usually over $1 billion in market cap and real companies with real revenues. As with everything we talk about, the stocks are currently reporting and trade on a major exchange. The BITE system works with Vector Nostradamus by taking the stocks it selects and then spreads over the top and finds three things: A future price target based upon its current trend, the actual date that it should hit that target, and finally, it finds a resolution date for when the stock is most likely to “jump the torus” or make an explosive move. Not all stocks have a resolution date. When we mention it, it is because the resolution date is quite clear. If we are working with the right VN stocks, the odds are higher that the torus jump will be to the upside, which puts the odds in our favor. Also, when we see the resolution date, it has been our experience that the stock often makes the leap a week or even two weeks before the date, so we don’t try to time the entry into the stock perfectly as the leap can occur around that resolution date approximately, but what we know is that if a stock is priced at X on the resolution date, the odds become high that it will move to our target price on time. Finally, we choose our stocks often because the move from the current price to the target price might be 20% from one stock and only 12% for another stock in roughly the same time frame – so we pick the stock with the higher implied return as per BITE’s forecast. BITE prevents us from “chasing” stocks that have spiked – although a stock that spikes might have a great looking RSI, it might also be poised to correct 5-10 points after the spike in a pullback, and BITE recognizes this and prevents us from entering if the explosion in price has already occurred.

Here’s a picture of our systems

In action:

See?

Now you know you have nothing to worry about.

It’s all about our computers.

LOL

——————–

ACADEMY WILL LAUNCH IN JANUARY

The Carnivore Trading Academy is on track for its first session in January 2023

More on that soon.

It will have its own website for people to find out more about it and to sign up and reserve seats for the training.

We’re envisioning about 4-5 days in Las Vegas.

Every night will be an event at the LV X-Mansion.

Comedy, magic, music, insane food, great food, 4 star chefs, fantastic wines, open bars, 3 acres of grounds with a putting green, pool, surrounded by 200 palm trees in a secure private estate literally 5 minutes off the strip.

But the most important reason you go to the Academy is to meet the other heavy players that are there for the camaraderie.

It is rare to gather so many great traders in one place at one time in a private, secure, fun venue where we can all talk freely and openly and learn from one another and make truly great human connections.

You will leave the Academy a Hall of Fame trader and you will have had an amazing time in the Capitol of Fun, Las Vegas.

I think we’re going to limit the first one to a small group and some of the seats are already spoken for.

I’ll let you know when the website goes live so you can find out more and make a reservation.

——————————–

MAKING MONEY IS LIKE SURFING

You want the secret?

This section is the most important thing you can learn, especially if you’re new to Carnivore.

Making money in stocks is like surfing.

All a surfer is looking for is a good wave, a winning stock.

He paddles into maybe 5 or 7 waves and pulls back out of the wave at the last minute because it isn’t “forming” right.

Those are the stocks you buy that don’t go up – they do down and you sell them.

Then, when he finds the right wave, he paddles HARD into it and rides it.

The analogy is that he doesn’t sell it quickly, he MILKS that wave for all its worth. If it were a stock, he would be adding to it over and over and over again as he’s riding it.

There it is. You get this, and I’m here to tell you, you will make money.

It’s simple to say and very hard to do, but if you JUST DO IT you will kill it. You will beat the shit out of your friends and others that have no clue how to bang real profits – sure they find the odd winner, but they don’t have the TOOLS that we’re about to tell you.

So without further talk, here it is:

You buy 10 stocks.

You put $10,000 into each one

Maybe 7 lose money. You cut those off quickly. Like you lose 7% on each one.

You have two that go sideways, so you do nothing there as they are still in their “pattern” – could be “in the box”, could be an ascending triangle. But nothing to do yet.

You have just ONE that is moving up.

You add to that one. $5,000 first add.

It goes up some more. You add another $5,000

Again and again and again – 5 times you add $5,000 as it goes up and up and up.

Finally, you sell it.

You make more money on that ONE stock than you lose on ALL the 7 losers combined.

Now you get it?

Here’s the math.

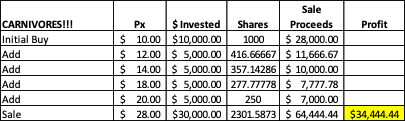

I buy 10 stocks at $10,000 each.

I sell 7 of them with a loss of 7% each. That’s $700 x 7 = $4,900 loss.

I have 2 of them that do nothing, go sideways, I’m still waiting to see how they act.

I have just ONE that goes up.

I bought $10,000 at $10/share. 1,000 shares.

I buy another $5,000 at $12/share.

I buy another $5,000 at $14 share.

I buy another $5,000 at $18/share.

I buy another $5,000 at $20/share.

I sell the whole package at $28.

My total gain is $34,444

I lost $4,900. Boo Hoo.

My net is $29,000 on a total investment of 10 stocks at $10,000 each, plus what I added to the winner, which is another $20,000 (paid for with the proceeds of the losers I sold BTW) and so at the most conservative level of math here, I had $120,000 out (not really but lets say I did) and I banked a net of $29,000. That’s a +24% return.

Even if you sold the stock at $22 instead of $28, your total return would be $15,000 or about +13% – on your entire portfolio value!

And this happens OVER AND OVER AND OVER throughout the year as we turn over stocks.

So when you do this entire process over and over, let’s say you do it 4 times in a year? That’s 24% x 4 = 96% for the year.

Yes, it requires that you find at least 4 stocks that are going to give you that move from $10 to $28. That is key. But they’re out there, and we do our best to find them.

But even if you only do it 2 times…that’s still a portfolio return of 48%!

And isn’t that better than what you’re financial advisor is saying is “a good return” for you to expect?

THAT is how, when people say “BS. You aren’t making 50% or 100% or 200% a year” we can say “BS right back, diptard! You cycle that very situation I just described 2-4 times and you have real returns.

And what if you click off 2 or 3 like every cycle?

Our example is that you only hit one out of ten!

Now you can see where the juice comes from, right?

Now you dig me?

I took 7 losing trades probably pretty quickly – maybe in the first 2 weeks trial with Carnivore.

But you don’t see our winner in the SALES report, because we are riding that wave. It’s laying there in the Positions Section at the top of every Wrap but you don’t see it.

This is why so many people think that after two weeks we just lose money.

They only focus on the stocks we’ve sold.

Not the ones we’re holding and adding to.

They’re too focused on how many stocks make money – which doesn’t matter at all really.

THE NUMBER or PERCENTAGE OF TRADES THAT MAKE MONEY DOESN’T REALLY MATTER

One has to focus on how much we make on the winners, versus how much we lose on the losers.

Which is ALL that matters!

HALL OF FAME traders make more money on their winners than they lose on their losers.

They leverage into winners and cut their losers relentlessly.

And for those poor souls that quit after the 2-week free trial because they’re not focusing on WHAT MATTERS, then they will remain the people we take money from in the market, the losers. And God bless them, we need them.

—————————–

I JUST STARTED WITH CARNIVORE

WHAT DO I DO NOW?

HALL OF FAME TRADERS

If you’ve already opened up your account at some commission free brokerage firm, and there are plenty that you can use – then you’re on your way.

Now you’re going to get into the flow of the Carnivore trades, our Hall of Fame Traders University where you learn something every day in this Market Wrap – either in the Commentary, or down below Dutch’s signature where we have some stuff that we leave in all the time because it payd to review stuff that is essential from time to time, and then in these segments here, where you see the True Freedom logo. That’s your sign that we’re sharing something we think might be of value to at least some of you. And we take it seriously – seriously enough that Dutch had the logo tattoed on his right shoulder to remind himself that this – True Freedom – is the mission of Carnivore – to deliver the skills to have true freedom eventually.

So what do we do now Dutch?

I was talking to Donk about this the other day, and we agreed that the best way for someone to start is to just watch the NEW trades that are coming. Why? Because these are the most timely for the moment in time that you’ve joined and going forward. And if you take your capital and divide it by 20. Let’s say you have $20,000 for instance. You buy $1,000 of the stock that is coming at you from Carnivore that day. The next day there will be another one. Another $1,000 goes into that one. And so on. When you see us ADDING to a position – if you own it, you add $500 to it (that’s just a suggestion, not what you decide to do – you do what you feel is right for you. Might be $250 – which is just fine!) If you don’t own it, ignore it! It’s a trade that you’re not in – it probably got bought before you joined, so just ignore it. Pretty soon, after a couple weeks, you’ll be pretty full up on your positions.

And then the fun begins.

You’re adding, your selling off stocks that aren’t working, and then you’re adding to the ones that are working.

You’re taking profits on the ones that are working after a month or two, and then redeploying that capital into the new positions that are coming at you from Carnivore.

It’s active, but don’t stress about it.

You don’t have to hit each buy exactly when we’re doing it.

We’re not day traders, so you’re not likely to be missing some $15 point run in a day, and in most markets, that’s super rare no matter what.

You’re paying attention to the Market Wraps so you can get a sense of what we’re seeing out there as to market tone.

Are we positive or negative on the market, are we driving into stocks hard or are we lightening up and cutting the number of positions.

If you miss something one day, you can just hit it or sell it the next day. It’s all good.

What you don’t want to miss is when we send out an ALERT that says something like “The bus is coming, get out of the street or it’s going to run you over.” Or, “We’re selling 80% or 50% of all our positions” or “We’re cutting our positions down to pay off all our margin debt”. These are signs that we’re getting nervous about the market and making moves to protect ourselves.

Just as important is when we see the market opening up and the bull starting to run, when you see us say things like “We’re adding to XYZ and ABC and DEF and HIJ and LMO.” Or “We’ve identified the sector we want to move into and its (for example) Homebuilders and we’re taking an initial position in DHI and are stalking entries on LGIH and GBRK” or something to that effect. Usually when we are moving into a sector that we think will have a run, we will expose to you the stocks that are the best in that sector, we’ll buy one or two or three on the first day to begin our position building in that sector. Like we did with Marine Shipping, our initial position was ZIM at around $28 and we traded it up and up and up, adding to it, as it began to work, and then we expanded our holdings into the sector hitting SB and GNK and GOGL – and finally, our last run in the sector was ESEA where we boomed a $10 point run in about 2 weeks. We dip into the sector after doing the homework, then when it works, we add to that initial position and we expand the number of position in the sector. So you’ll see that and you’ll be reading our Commentary in the Wrap so you’ll be step for step with us and know what’s up.

Meanwhile your friends are selling AAPL and buying AT&T because their “financial advisor” told them to. Stupid. BTW that’s a true story. Hippie Chicks advisor told her to sell AAPL when it was around $115 and told her to buy ATT and CLNE. When Hippie bought TLRY at $17 because she saw us doing it, and it went to $63 in like 2 weeks and we sold, she called her “financial advisor” and told her to sell it – and the financial advisor talked her out of it – and it went to like $7/share. Nice move. Who doesn’t sell when a stock goes from $17 to $63 in 2 weeks? Crazy! Today’s “financial advisors” are just not that smart, OK? We know, we watched Wall Street “dumb down” the whole profession so that any washed up diptard could qualify to become one. Sure she might have a great body, but she’s dumb as a rock and if you listen to her, well, good luck with that. They were NOT taught how to trade. They’re concierges. Let them take you out to lunch or dinner and pay for it, but don’t let them mess around with your money in stock trades!

Anyway, I digress.

Good luck to you and stick to the regimen.

Stick to the process.

Buy, add when it works, if it keeps working, keep on adding. When it doesn’t work cut it. Keep surfing for the big wave you can add, add, add, add and ride and ride as it spikes and runs. Then pull the rip cord and bank the dollars.

——————————–

ARE YOU CUT OUT FOR THIS?

Did you think when you signed up for Carnivore that this would be easy?

It isn’t.

Trading isn’t for everyone.

It means you have to learn and you have to get involved and you have to make your own calls now and then.

There is only so much we can do showing you what we’re doing and writing this wrap to help you understand.

But if you do get involved, you can make great returns.

And here’s an email that proves it:

Wed 12/15/2021 8:54 PM

To: dutch

I took the spxu trade off yesterday because I thought that was it for the down, so that was a 3% win for me.

I scalped a few points (cents) on the dia short.

I did two large uec trades today on your buy, sold the first one at 3.51 (chaching) and I’m holding the second one until you guys sell.

I did quick math and in my trading account I’m realized 73.34% ytd and that’s before the uec trade. For context my realized profit for the last three years has been 13%, 11% and 17% so back of the napkin math carnivore has given me a 60% increase on my average returns. 60 F_ing percent! And I only became a carnivore about half way through the year! Next year is going to be epic!!!!!!

You guys rock!

Mike

Thanks Mike!

We love you to man!

A true CFL that has found True Freedom, for sure.

What Mike is telling you in the email that he sent just a few days ago – is that he signed up, he took it seriously and he learned like crazy.

He makes some of his own moves – but likes to use Carnivore as a market guide and he keys in on some of the trades we’re doing.

And look at his returns.

That’s a real guy, real email, and the real truth.

When we get this kind of response – we know we’re making it happen.

We know that some people get it, are doing it, and its working for them.

Trader z likes to say “Why would anyone think that this is any easier than making a lot of money in any other endeavor or pursuit?”

H’s right you know.

It’s a lot of work to own any business, and most people’s jobs aren’t that easy either!

Nothing is easy. Nothing.

You just have to choose what lifestyle you want, what level of independence and freedom you want.

We found trading gives us the ultimate True Freedom.

There are fantastic benefits to being a trader.

You can work from anywhere, you can go to work or not, you don’t have to hire anyone, you have no product to sell, you have nothing to spend money on advertising for, you have no warehouse and no shipping.

It’s a dream job.

You can have True Freedom!

BUT

Nowhere did it say that it was easy.

We’re not a stock tip site.

We’re not stock brokers or financial advisors.

We simply show you what we’re doing, what our systems are triggering, what we think is happening, strategies and tactics we are using to manage the rough waters.

Advanced tactics and techniques your stock broker has no idea how to even do.

Seriously, he or she has never done a market neutral trade or a pairs trade in his or her life.

Betcha.

But YOU can learn how to do it.

And you can learn how to trade – advanced or not – and make real money.

Like Mike in the email above.

—————————-

MAXIMIZING PROFITS WITH CARNIVORE

Our mission is clearly to bring as many people to True Freedom as possible.

That means they have to know how to use what money they have to drive profits and build up a massive portfolio so they can tell their bosses to get lost, walk out the door of that toxic cubicle ridden hell hole that they work in, or leave whatever other thing it is that they do that they HATE. Now we don’t claim that trading is a panacea for everyone, it just happens to suit us very well, and we don’t want to do anything else, but Dutch can’t make beautiful cabinets or build gorgeous houses or fly an airplane – so this is what he loves to do. If he could fly an airplane and he loved doing it, then that might be True Freedom for someone else. Which is super cool.

To maximize profits with Carnivore’s way of doing things…we start with how our style makes money.

We don’t try to pick 100% winners.

We want to find the stock we can get to trend for us, then when we see it, we want to move into it aggressively by adding to the position – and get greedy when we’re right.

And when we’re wrong, cut the position quickly.

This means that we’re going to have maybe 10 positions that don’t work, that we sell at small losses in small dollar amounts.

And then, when we find the runner, we start to build a position as it goes up, aggressively, so that we take a large profit, on a LARGE dollar amount.

There’s an art to this.

There’s not a hard and fast formula.

There’s an approach.

And here it is:

We find sectors that are maybe going to be working, that have Relative Strength.

We find stocks in that sector that have a reasonable market cap, that have liquidity, that have a decent chart setup, that ideally have decent fundamentals instead of just a story.

We look for the signs that it might have a catalyst to take it higher, even if that catalyst is not obvious.

Earnings releases are dangerous and not the best catalyst because how many times have we gone into a stock in the past before earnings, they have good earnings, and the stock sells off?

A lot of times.

We look for the oblique catalyst, such as the price of bitcoin to the bitcoin miner stock.

It’s not a direct catalyst, but its pretty strong.

We look to see what the prospects are for bitcoin – to provide us with some wind in the sails to the trade in the miner stock.

If we’re right, we can get into a trending situation and start scaling.

If we are wrong, and we are going to be wrong – then we have to cut the loss quickly and move on.

Find the next opportunity.

It really is just that simple.

Easy to intellectually understand but hard for most people to do.

They don’t want to sell something that is a loser, no matter how small.

They fail to scale in and buy more of the winner.

But the losers that you sell fund the scale into the winner that is moving the right way, and we have to “get that”.

——————————-

WHY WE STARTED CARNIVORE

The below is a sneak peak of a chapter in our new book that we’re writing.

It exposes Wall Street’s evil agenda and calls out the lies they’ve told the average investor for the last 20+ years.

Carnivore wants to change the game.

“I’ve been walking in the footsteps of societies lies. I don’t like what I see no more.”

Lyrics by Jon Bon Jovi and Richie Sambora

“Wall Street has changed. There was a time when the soul of Wall Street was a core group of men and women that made people real money investing in and trading in stocks. These people were damn artists, they were amazing and smart and wicked quick. They knew how the Street worked, and they knew all the tactics and they were clear headed they made people real money…and they did it with stocks. They were allowed to trade their own money alongside their clients. They were allowed to take $25 million in an account and put it in 8 stocks. The mantra was, “As long as its legal, you’re free to do it here. Just make money for the firm.” There were no caps on your compensation. If you made the firm $100 million – doing whatever the heck it is that you knew how to do – the firm paid you $30 million. And they were happy to pay it to you. They were ecstatic and they said, “Do it again next year!”

There were no mutual funds. Then the lawyers and so-called businessmen (bankers from traditional banks) came along and took over these firms. They did not like paying someone $30 million. They did not want someone to trade stocks because trading stocks meant that they had to pay the guys that knew how to trade! And when trading volume was down, they didn’t make as much money…and God forbid, they couldn’t have a quarter where they announced earnings are less than last quarter. See, by then, the partnerships that were Wall Street had vanished and they were all public companies now. These bankers and lawyers at the new public companies said to themselves, “How do we smooth out our earnings, make sure we get paid no matter what the market is doing – no matter if the clients are making money or not?” And the answer was:”Let’s create products that “wrap” stock trading and these products will charge the clients an annual fee. That way, no matter what the market does, no matter how the client does, we always get paid. We then can cut the big pay to the traders and save that money, too.” And that’s how mutual funds and hedge funds and “wrap fee accounts” were born.

“But how do we make all of this happen?”, they asked. The answer was simple: We tell a bunch of lies and use fear and selective data to drive the clients into these products. We tell them that Wall Street is very complex – too complex and dangerous for their little minds to handle, and that they need to have “professional money managers” running their money at these mutual funds and such. We also make up stuff like “You have to be diversified” and “diversification works” and “diversification is smart” even though we know that diversification doesn’t work, concentration works, but we scare them with fear and drive them into multiple products that ALL pay us annual fees. We also tell them that they must stay invested in the market at all times. This is very important. If we can get them brainwashed into always being invested, we always get our fee. We cannot let them “go to cash” because then we don’t get paid the fee. So we make up little sayings, little lies, like “Its time in the market that matters, not timing the market.” Or, “If you were out of the market on the best 20 days each year, you would have lost money.” Lies like “you have to invest like Warren Buffet and be diversified” even though he wasn’t diversified at all while he built his empire! They say all these trite little one-liners which are often untrue or that use selective data and are arguably outright false quite often. They are carefully designed psychological manipulation tools of the evil empire that Wall Street has become.

We lived in a world of these lies and we saw that these so-called products, these “professionally managed accounts” are literally structured to produce mediocre returns. They’ve boxed the investor into a range of -7% to +7% a year returns. And they’ve set it up such that they get paid no matter what that return is! We watched as the great traders were pushed out the door of our once great firms by the lawyers and businessmen that made their lives miserable with a thousand new rules and regulations that were designed to do just that – get rid of them. So gone are the brokers, the old school traders, the men and women that knew how to make real money for clients. They have been replaced by a generation of dopes that they called “financial advisors” who were brainwashed into the new “system” where they were told not to trade stocks, but just “gather assets” and put it to work in the markets through mutual funds and ETF’s and hedge funds and such. Structure a 60/40 portfolio and tell people that this is safe when in fact, as we have shown you, the 60/40 portfolio is structurally a guarantee of mediocrity and possibly losses over the next 5 years as rates rise! Tell the clients all the lies we teach you, the lies about diversification working and being constantly invested in the market no matter what and that they need really smart people at mutual funds and hedge funds to manage your money for you.

It’s all bullshit.

The sad thing is, this plan of theirs has worked. People now invest in mutual funds that don’t perform. They are told that a 7% return is a good return for a whole year. And people buy it.

At Carnivore, we never lost sight of how our mentors and teachers taught us. We have experienced how diversification does not work. When the SHTF everything goes down! Warren Buffet was never diversified for 20 years – something like 25% of his holdings were in one stock. Geico. It made his numbers for him. It made him famous. But he was not diversified, he was concentrated. We can show you that the average mutual fund barely makes 5% a year. We can show you that hedge funds and private equity funds are totally set up to make money for Wall Street and not you, the investor. You are an after-thought. You are the fodder, the last man to get paid.

We are a throwback to the old ways. And now, with commission free trading platforms, the “friction” has been removed from the system, you no longer have to worry about the cost of the trade when you trade, you only have to worry about the trade itself and if it’s a good trade or good investment. We love that. It has driven 50 million new investors into our markets, just the way Discount Brokerages did when they first came along.

But what to trade, how to trade, when to trade, when to be in the market, when to be out? How do you successfully trade? What are the rules? How do I minimize risk and maximize gain? All these things we address here. We were all taught how to do it, now we can hopefully pass it all on to another generation. Will we be successful at reversing the damage that the bankers and lawyers have done to the average investor? No. Will we be able to show people how you make 20%, 50%, 100% a year in the markets and do it trading really high-quality stocks? We hope so. We teach by doing. We teach by showing you trades every day and sharing with you our best thinking on the market. Our wish is that maybe, just for a few people, we can change things for those that call themselves Carnivores For Life.”

CFL!!!

————————

CARNIVORES KNOW…….THERE IS NO SPOON!

“Do not try to bend the spoon. That is impossible. Instead, only try to realize the truth. What Truth? There is no spoon. Then you will see that it is not the spoon that bends, it is only yourself ”. – The Matrix

——————————-

WHAT IS THE VIX?

Carnivore University

The VIX is your indicator that judges market sentiment and the degree of fear of market participants. It’s technically the markets expectations for volatility over the next 30 days. In other words, the higher the VIX goes up, the more people are freaking out and the more likely, we think, there is a possibility of a major event. It’s never a good event that drives the VIX up, OK? VIX around 13 – 15 your ass is in high cotton and everything is super cool. VIX under 20, things are still pretty cool. Over 20, things are starting to get dicey and you should get a plan together to cover your ass potentially. Over 25, watch your ass because the bullets are about to fly. Over 30 your ass is feeling a lot of pain and the bullets ARE flying. Over 40 and its too late to cover your ass and your ass has been shot to hell most likely. I guess that is what you could call Carnivore’s “VIX/ASS” scale. We’re at 25 and I would say that we’ve already seen a couple bullets whiz by our heads, and this thing might be heading to 30 and your ass needs to be covered BEFORE it gets there. When you see the VIX soaring to 60 or 70 or 80, its time to look at buying. At that level, the event has happened, everyone knows what it is, and its simply not going to stay up there for long. It will come back down – and as it does, the market is going up. And THAT, my beautiful Carnivore’s, is flat out the best and only lesson on the VIX you’ll ever need to know. Put the VIX up on your watch list. Now you know how to use it.

—————————————–

JANUARY 2021 – SELECT WINNERS***

Here were the most notable winners for January in order of % gain:

TLRY: +80.31% 7 days

PLUG: +78.26% 6 days

SPCE: +69.51% 7 days

WKHS: +57.95% 5 days

DQ: +42.32% 7 days

YALA: +41.69% 27 days

FLGT +23.20% 4 days

FEBRUARY 2021 – SELECT WINNERS***

Here were the most notable winners for February in order of % gain:

SFTWwt +278.57% 200+ days

TLRY +113.13% 28 days

CCIV +91.69% 14 days

QFIN 56.63% 11 days

FUTU +54.47% 7 days

PLTR +35.79% 5 days

SPCE +35.37% 6 days

SFTW +29.58% 49 days

FLGT +23.09% 5 days

SPCE short +17.59% 1 day

MARCH 2021 – SELECT WINNERS***

Here were the most notable winners for February in order of % gain:

RKT +49.45% 8 days

UEC +32.42% 21 days

VIAC +17.69% 8 days

LIVX +13.51% 1 day

TRIP +11.37% 3 days

MOS +6.82% 10 days

April 2021 – SELECT WINNERS***

GOGL +18.90% 18 days

ZIM +17.02% 16 days

APPS +16.66% 8 days

AMAT +15.95% 6 days

YETI +13.35% 17 days

MT _+11.96% 26 days

QFIN +11.12% 9 days

DKS +8.48% 8 days

FCEL +8.06% 6 days

RIO +7.2% 17 days

May 2021 – SELECT WINNERS***

SB +22.12% 4 days

VVNT +19.07% 1 day

VZIO +16.00% 19 days

VALE +15.15% 21 days

ZIM +13.13% 13 days

STNE +12.32% 12 days

QFIN +11.39% 5 days

GOGL +10.65% 11 days

AI +10.13% 5 days

GNK +9.77% 13 days

FF +9.49% 2 days

June 2021 – SELECT WINNERS***

GLBE +90.84% 29 days

CLNE +41.85% 5 days

NVDA +22.56% 24 days

APPS +17.51% 14 days

PERI +17.50% 4 days

SKYT +16.78% 5 days

MRVI +15.38% 28 days

HNST +14.80% 5 days

FTCI +14.50% 17 days

GNK +12.70% 39 days

NVDA +11.17% 11 days

GOGL +9.96% 7 days

SB +8.49% 33 days

July 2021 – SELECT WINNERS***

GLBE +148.82% 47 days

BNTX +29.14% 9 day

NVDA +29.19% 37 days

TEAM 26.85% 16 days

BTBT +22.94% 1 day

DQ +17.95% 9 days

INTA +14.67% 4 days

FTCI +14.5% 15 days

TTD +12.58% 9 days

SPXU +8.32% 3 days

August 2021 – SELECT WINNERS***

BNTX +76.60% 19 days

TEAM +26.03% 54 days

INTA +23.06% 1 day

BTBT +10.34% 6 days

ZS +9.19% 39 days

PYCR +7.72% 8 days

September 2021 – SELECT WINNERS***

ESEA +46.86% 13 days

RSI +36.72% 33 days

SENS +16.67% 43 days

HUT +13.15% 1 day

WIT +9.65% 10 days

SB +8.39% 1 day

CFLT +8.15% 9 days

October 2021- SELECT WINNERS***

MARA +33.02% 13 days

XPOF +24.44% 6 days

CCJ +22.58% 11 days

UUUU +21.88% 45 days

HUT +18.87 10 days

FLGC +14.6 1 day

UROY +14.12 1 day

URG +12.09 1 day

BTBT +10.02 1 day

November 2021 – SELECT WINNERS***

UUUU +76.90% 67 days

MARA +58.22% 9 days

HIVE +50.41% 12 days

RANI +44.65% 6 days

XPOF +25.87% 22 days

LAC +24.01% 16 days

CFLT +17.07% 1 day

ALB +13.9% 12 days

SKLZ +13.45% 5 days

AGTI +12.47 20 days

EVC +11.76% 14 days

CELH 10.25% 18 days

December 2021 – SELECT WINNERS***

GFS +22.30% 34 days

PFE +14.01% 18 days

OPNT +13.50% 5 days

ENPH +11.4% 8 days

RANI +8.64% 11 days

———————-

DO A TRADE! DO 3 OR 4 TRADES!

The most important thing one can do is get their uniform dirty. Do a trade. Get in the game. Learn by doing… Do 5 or 10 trades. Trading is free. There are no commissions so there is no friction to move into or out of a position. No reason not to trade.

—————————————–

Options Traders: We don’t do options trades. But…we are in the business of finding explosive stock situations. Options traders can and do “key” off of what we’re buying in the stock market and make their own determination on what, if any, options to buy on those underlying stocks. Many options traders seemed to have had success in using some of the stocks Carnivore trades as a source for their own options trading.

Long Term Investors: Carnivore only works 99% in high quality growth companies and high-quality stocks. Many long-term investors use Carnivore to discover companies to invest in that we believe are the future Googles, Apple’s, Microsoft’s of the world. One comment we routinely get is “I never even heard of that stock before!” and they are surprised to find out how big they are and how fast they are growing. Our systems and research and methods and contacts alert us to these stocks that many people have never heard of but that are quality stocks, not penny stocks. With the quality of the stocks we trade in one should never feel the urge to buy a crappy penny stock again. The list of great stocks we have introduced to Carnivores over the last 2 year is awesome.

Carnivore trades mostly in stocks that have a market cap over $1 billion and all our stocks must be currently reporting and trade on a major stock exchange.

—————————————–

WHO ARE THESE GUYS?

DUTCH

He spent his young professional career on Wall Street searching for brilliant young people and hiring them, then submersed them deeply into the Wall Street trading culture, literature, economics, philosophy, and politics. His aim was to create a group of “super-traders”. These many years later they have become the core of many of today’s largest hedge funds and trading desks on Wall Street. They’re like Spectre – they’re everywhere. And their bosses don’t know. And some of them ARE the bosses! They now contribute to Carnivore and provide Dutch with their intelligence and expertise some 2 decades later. His creation of the BITE system works in concert with Trader Z’s system Vector Nostradamus (described below). BITE is unique in the system takes Trader Z’s picks and delivers a target PRICE and a target TIME FRAME as well as a behavioral-based STOP LOSS. Combining the firepower of Vector Nostradamus with BITE we think creates a powerful trading package and we share that with our subscribers in real time.

SWAMP DONKEY

Known as the smiling assassin. This name comes from the fact that he is affable and friendly, but smarter as heck, and if he thinks you’re a Cramer, he will never let you know it. He is a unique character with amazing trading abilities, he has bright flashes of brilliance that come randomly and unexpectedly like bolts of lightning. He actually holds the trading desk together. Without him these animals would simply kill each other. His brilliance is masked by his southern United States upbringing and simply his humble style of being. His profitable trading calls have been epic and legendary and include some of the biggest winners in Carnivore history. He has an uncanny knack for finding special situations.The collaboration of Trader Z, Dutch and Donk works to bring Carnivore probably the best trading team on the Street today.

TRADER Z

An anonymous Carnivore trader that is known as the best living trader on earth today. Deeply schooled in multiple traditional and esoteric trading methodologies. Fairly young man with an IQ above measurable range. Discovered at age 20 by Dutch and through multiple discussions, Dutch saw that Trader Z understood capital markets and economics and specifically grasped the nuances of how markets moved in relation to one another and the subtle and direct inter-relationships of politics, policy and economics and how that caused price movements in stock, bond, currency and commodity markets…knowledge that most seasoned Wall Street professionals did not grasp after a lifetime on the Street.

The genius of Trader Z developed further under Dutch and Donk at a major Wall Street firm. Trader Z was later tapped to handle complex investment and trading strategies at some of the largest investment houses where he spent much of his free time immersed in studying the Sacred Vedic Scriptures of India where they hid numerical, geometric and astronomical codes revealing the natural order of the universe, advanced cosmology and mysticism, the science of spiritual and material transmutation, the arithmetical and geometric keys found in astrological codes found in ancient Egyptian work, the mystical traditions of Qabalah, Freemasons, and Cathedral Builders, the work of Plato, Pythagoras, Elizabethan polymath John Dee’s work on the divine cosmos and geometric time, the Avatamsaka School of Buddhism, Chinese Jua-Yen Buddhism…the list goes on and on.

He created his own system, which he calls “Vector Nostradamus” that is one of the tools the Carnivores use to spot market trends and tone, and to identify the sectors and stocks to invest in.

—————–

Subscribe today. Tell your friends.

Eat steak with us every night.

Have you told your friends to sign up?

——————————

Welcome to the new Carnivores.

We are glad you are here. It’s been amazing…the word of mouth. Telling your friends about us. So very cool. We’re so appreciative. Disrupting the way people make money on Wall Street. With your help, growing like crazy.

—————

HOW WALL STREET REALLY WORKS

——————————–

Carnivore Trading

——————————–

Small cap, mid cap, large cap stocks.

Liquid.

Institutional quality trades for institutional quality clients.

No penny stocks.

No micro caps.

——————————-

Real Traders. Real Trades. Real Time.

——————————–

WHAT IS A “HALL OF FAME” TRADER?

Definition: “Over the course of a time period, a year for example, the number of trades that are profitable are over 50% of all trades, AND, over the same period, you make more – on average – on winning trades than is lost on losing trades.”

It is possible for a trader to make money and have only 30% or 40% of his trades be profitable trades… and the rest losing trades, and many traders do just that. In those cases, that trader must make much bigger profits on each winning trade than he loses on losing trades. It is also possible to make money if you don’t make more on your winning trades than you lose on your losing trades IF your winning percentage is up over 70% or even higher. We saw a trader that almost always lost more on his losers than he won on his winners, but his winning trade percentage was around 80%. The guy had a huge winning percentage. Now imagine if that same trader cut his losers faster and he switched that ratio as well? Then his returns would be truly spectacular.

—————————————

THE THREE THINGS YOU MUST LEARN TO DO

First, when we do an initial buy, its small 99% of the time. So start small. When it starts to work, we start adding to it, we call that scaling in. We add, we add, we add and then if it keeps on working, look! Now its in the top 10, then the top 5 stocks. Scale into the winners.

Second thing: Ride the winners up…and cut your losers quickly. Most people do EXACTLY the opposite. I’ve seen it on paper, OK? You get excited about a gain, you take it. A $400 gain on GLBE should have been a $5,000 gain on a $7,000 investment. But you put in $7,000 into the trade and you took it off when it was up $400! What are you doing? Your account should, at the end of the month, your statement should have a series of small losses. A fair number of trades where you took small losses. And a few bangers where you had been riding something up for a month or so and then you sold it. So – loss of 2.5%, loss of 5%, loss of 3.8%, loss of 4%, GAIN of 41%, GAIN of 67%, GAIN of 21%.

And that leads us to number 3 thing: It is NOT IMPORTANT that you win on all your trades. In fact, it is the least important part of all of this. You can lose on 70% of your trades – if you’re taking a series of small losses – and make money because on the 30% of winners, you make serious bank, real money, you scaled into the stock as it was going up, and you rode it like we just did today with GLBE from $28.80/share purchase to $52/share sale. That’s a banger, that’s a boomer, that’s what makes up for the FLL’s and the BGFV’s that we take our small losses on, OK? That’s called Money Management! You’re scaling into winners, you’re taking a series of small losses, you’re cutting losers – remember they don’t care that you own them, only you do and that’s just foolish. Never, ever get married to a stock. It will cheat on you in a heartbeat! So if it isn’t working, throw her or him to the curb like the dirty trash that he/she is! It’s just a stock! Opportunities abound! It’s like blondes in California…there’s one walking by every 4 minutes.

Review:

Start Small

Scale into winners

Cut losers quickly

The number of winners versus losers is not that important. Your money management is!

——————————–

YOU WANT TO TRADE BETTER?

Remember Gann’s Rules.

Divide your capital into 10 equal parts and never risk more.

Use Trailing Stop Loss orders – always protect your trades and your capital.

Don’t overtrade (have too big or concentrated a position)

Don’t let a profit run into a loss.

Trade into a trend, not against it.

Don’t average down into a loser.

Trade only in active stocks and active markets.

Don’t close your trades without a reason.

Don’t trade just to get a scalping profit.

If you’re in doubt, get out. Clear your mind.

Never buy something just because it is low priced. It can go lower.

Pyramid into winning trades and let your winners ride.

Cut your losers quickly.

——————————–

WHAT MAKES CARNIVORE DIFFERENT?

99.99% of stock services adopt one method to use in picking a stock. There are guys that only use fundamental research and they don’t care about the entry point on a trade, they don’t care that the chart looks horrible, if the fundamentals are strong, they’re going to show that stock to you. Same with the technician. He’s looking at the charts and he doesn’t care what the fundamentals are. If the pattern in the chart tells him to buy it, he buys it. Both the fundamentalist and the technician care little about macroeconomics or sector analysis. They don’t ask “Is this stock gong to benefit in this economic environment? Is this sector a good one to be in right now? Finally, the technician may use only one indicator, like Relative Strength, to make up 80% of his call on that stock. None of them combine all the things that we do into our trading style. It is this approach that no one thing works consistently all the time that we understand, and that we use to our advantage, because we can identify an opportunity that is driven by a pure technical indicator, or macroeconomics, or a sector call – equally and without being constrained by a single style of methodology.

At Carnivore, we start with macroeconomic research…the big picture. How is the economy? What parts of the economy are going to do well? That tells us what sectors are going to do well. Then we go to the stocks themselves in those sectors that we have already determined should do well. We do a lot of fundamental research at this point. Who is the Rolls Royce top of the line company in this space? For example, if we think microchips will do well as a sector, we find ourselves looking at the NVDA and AMD and AMAT’s of the world. Because if we’re right about the sector, then those will attract the institutional money that can really drive a stock. A lower quality stock might get some of the move in the sector, but it might not either, because it can’t attract the big money the way a higher quality stock does.

After that, we start the technical analysis. Charts, technical indicators. We determined the small number of quality stocks in the sector that we like and now, who has the best set up? This is where the technical indicators come into play and the patterns on the chart start to reveal which stock is closest to a resolution date, which one is poised for a breakout, whatever.

What makes us different? We incorporate macro-economic analysis with sector analysis with technical analysis and fundamental analysis…and then we add the chicken bones, the esoteric ancient wisdom stuff that some people scoff at, such as the Law of Vibration and Universal Laws that govern the movements of all things.

——————————–

OUR APPROACH

I guess you could call our approach the Quantimental Approach. Quantitative data combined with fundamental screens that helps us find stocks that are going to go up in price. Z sees himself as a navigator on a ship. You have no control over the ocean and weather, all you can do is react to it. But with years of experience, they can see patterns of weather and clouds and water and wildlife, and they can see things that others don’t see. They know when to turn, when to speed up, when to slow down, when to turn around. Ultimately, the growth and fundamentals have to underly the business because this is what saves us. If the stocks were playing in are great fundamentally, if the market tone changes quickly and we get trapped, we have to be in stocks that can recover when the market does…and that means the growth stocks with high margins and lots of money, which is what leads us to the names you see us in. These are winners, these companies. These are, mostly, all big, liquid, high margin, monsters that are winning, have strong RSI, and are in some cases just juggernauts in their fields.

Once we have the fundamentals right, then it’s all about the technical set ups, the patterns, the indicators, and patterns we like to see that have played out for us over time many times.

And finally, after that, we have the rules. The Gann rules (below) about dividing your money up by at least a factor of 10 and that’s how you invest – 5% initial trade is a good start and then adding 2-3% every time you add and add like crazy and often to the winners. Keep it tight, invest small, scale in, scale in, cut losers fast and drive hard into the winners and let them run.

In a nutshell, that’s our approach.

THE LAW OF VIBRATION

One of the things we believe fundamentally – and apply to the stock market – is the Law of Vibration.

We believe that the evidence is overwhelming in physics, Universal law, Natural Law, and from all that we know from our study of ancient wisdom, is that everything vibrates at the atomic level and above. Some things, like a piece of wood, may not appear to the naked eye to be vibrating, but it is, at the microscopic or atomic level. This is generally accepted. With stocks, we can actually SEE them move – and vibrate. Their movement is obvious and visible and easily charted. We understand that they do this as a result of Natural Law wherein forces – buying and selling – cause them to move. We believe further that if one can visualize a stock moving in a 3-dimensional world one could see that it is moving through what Gann referred to as the “Tunnel in the Air”. We can see stocks moving towards us and away from us in this 3-dimensional plane. How to see this is a more complex discussion but suffice to say that through the decades we have been doing this, and with the help of Gann and others, we come to a conclusion that this path that a stock takes can be viewed in multiple time frames, and it is up to us to choose which time frame we want to analyze. Carnivore is more short term oriented, like that of a smooth swing trader, with a time frame of more like 0-6 months with the usual trade happening within 30-90 days and further, more often inside the 30-day window. When we trigger a buy on a stock it can be assumed that we are doing it for a trade inside 30 days and that we see the opportunity for an explosive move, or at the least, a profitable trade. We know that we are going to be wrong about 50% of the time, and this is a given. As a result, profits must be maximized by scaling into a trade that is winning, and losers must be cut quickly in order to have a net positive result at the end of any time period. We try to hold ourselves to a goal of producing positive results each month, and we have a record of achieving that usually. This means that we must analyze the market carefully and decide which sectors to leave and which to focus in so that we are first and foremost in the areas of he economy that stand to benefit over the nest 1-3 months. It is not possible to say how immensely difficult this aspect of analysis is to get right consistently, but we have so far had a pretty good record of being where we should be and avoiding horrible sectors, but we have sometimes been too early in our moves into a sector and been hurt. We are not perfect, and we make mistakes, and the market, which is a brilliant mechanism designed to take our money and make us make mistakes that cost us money, is a humbling place to earn a living.

Having said that, stocks vibrate.

You will see in our charting work that we say the stock is “vibrating in the box” – some call this trading in a high-level consolidation pattern, and that is essentially the same thing. We like to draw a box around the stock so that we aren’t fooled by the movement and get shaken out of a good potential trade just because its vibrating – the box or triangle patterns we draw allow us to stay with positions that others leave as long as they are still within the pattern. It also enables us to leave a position that falls out of the pattern when it does so clearly.

Stocks vibrate and travel through the box or through the tunnel in the air, and then when they decide to move, we call that a torus jump – and that is when the stock has leapt out of the existing energy structure that it has been in, to a higher level of energy – a new level of energy. Others can call this “gapping up” and that means essentially the same thing, but that obfuscates what we believe is happening scientifically – the vibration.

Some call this “alternative science” or “esoteric”. And that’s fine.

We like to use a multi-disciplinary approach, and this is just part of that.

We just call it “The Chicken Bones”.

——————————–

CARNIVORE CHART UNIVERSITY

WHAT DOES “IN THE BOX” MEAN?

Often we look at a chart there isn’t a clear wedge or triangle pattern that is obvious but the stock appears to be in what some people call a “high level consolidation”. That’s “The Box” we talk about. We believe that all things have a vibrational element to them and stocks are no different. When a stock is vibrating around in the box and moves with tremendous energy to a new level of price, we call that a torus jump and we say that it has jumped to a new higher level of energy where it may repeat the pattern once again.

While a stock is “in the box” it is vibrating up and down, shaking people out and bringing other people into the stock. This movement, which we call vibration, has a function – and that function is to shake people out of the trade, either out of frustration or fear of loss. A frustrated trader has, in his mind usually, the idea that the stock should move for him – in the direction he wants it to move – at some time frame that he chooses in his head. The stock doesn’t care what the trader wants, however, and may trade sideways for some time, vibrating up and down. The size of the box is determined by up and down action of the stock. It might have 3 or 4 high prints and 3 or 4 low prints that allow you to “see” the box. We draw it in a lot of our stock charts so that we can see it clearly. This is extremely helpful to a trader because when the stock makes a down move on us, we don’t want to be selling out of the position if all that it is doing is vibrating inside that box. We sell when the stock either drops outside the pattern (below the box) or when it “jumps the torus” and leaps to a new higher level of energy. Maybe we have stock that has moved down 4 days in a row and our human instinct is to get fearful and frustrated and sell it. But the stock is still in the box! So we can easily see that in our charts and simply move on without doing anything…and wait for it to jump the torus (gap up). If it falls below the pattern – below the box – we look at selling it.

These are not hard and fast rules, we sometimes violate them when we think we know something, but usually we don’t…and usually, it’s better to sell when the stock drops out of its pattern.

Every week we give you insights into the patterns we’re using to identify trades and track the progress of a trade.

—————————————-

RESOLUTION DATES

Something that we pioneered here at Carnivore was finding the point in time in the future in which a stock will “resolve” within its pattern. Not all stocks give us this clear point in time in the future, but many do. Say for example, we have a stock that is in an ascending triangle or wedge pattern. By extending the trend lines above and below the stock, we see a triangular pattern appear. At the point, where the two lines meet – that is the resolution date and price. What it tells us is that if the stock is at that price – on that date – then the stock should resolve itself towards our target price at some point in the near future. After tracking and charting hundreds of stocks over the years we began to observe something interesting…the stock almost seems to know that there is some resolution date coming up, and that it will need to make a move – either up or down – on or before that resolution date. We observed that these stocks often leap to a new level on the resolution date or within 5-10 days on either side of it. At first we started to think that this was some kind of coincidence, but after you see it happen 50 times a year just in the stock we’re trading, then you start to take it a bit more seriously. We started taking it seriously and we continue to be amazed at how uncanny this is.

Full Disclosure: We have not done any long-term study on this and stocks sometimes resolve themselves down, not up. It doesn’t work 100% of the time. What we do to increase our odds – increase the probability that it will resolve in the direction we want it to – is to only trade in stocks that have this pattern of jumping the torus in the past, that have made the move we’re looking for, and/or only trade in stocks that have the underlying fundamentals that are likely to drive the stock up due to a strong earnings report, or a jump in revenue, or some other catalyst event. We want to be playing on the field where these stocks live and stay away from the boring stocks that will rarely give us that torus jump. This is why you see us in newly issued stocks that have a lot of energy and action, or other such stocks that have the same.

Here are stocks that were clearly in the pattern and heading to the resolution date.

MDB resolved almost exactly on the resolution date.

————————————

THE MARKET

OUR MAJOR CALLS ON THE MARKET FOR 2022

Call Made: March 14, 2021

DOW

NASDAQ

S&P 500

Bitcoin

Ethereum

Terra Luna

Treasury Rates

——————————–

WHAT IS A PROFIT FACTOR?

This is something we want you to get familiar with. You can do your own calculation on it on your trades.

What it does, in summary, is provide you with a very clear analysis of your trading on a risk reward basis.

You want your Profit Factor to be over 1.

If you’re profit factor is over 2.0 then that implies that for every dollar you’ve lost, you’ve made over 2 dollars.

A 1.5 to 2.0 Profit Factor is outstanding.

Why is this important?

Because you all remember what it takes to be a Hall of Fame Trader, right?

The definition of a Hall of Fame Trader is one that makes more on his winners than he loses on his losers, AND who has more than 50% winning trades.

Sure, you can make money with only 45% winners if you make so much more on your winners than you do your losers. That has actually happened to us in some months.

But if you consistently make more on your winners than you lose on your losers, AND you have more than 50% winning trades, that is insane and you’re in the Hall of Fame.

—————————————-

WHAT IS A RESOLUTION DATE?

BITE is one of the two major systems we use here. BITE is a system and a methodology, and it produces a price target and a time frame on a stock. It also sometimes gives us what we call a resolution date. The pattern is such that the resolution date occurs when – for example – a triangle will come to a peak as in the chart below. As long as the stock is in the pattern we call it “constructive”. If it falls out of the pattern, it “broke”. Often, when a stock is “moving through the tunnel in the air” through the pattern, it is winding tighter and tighter and then it explodes – or resolves. Ideally we like it to explode to the upside if we’re long the stock (own it) – and we have found that often the stock, as it is moving through that tunnel in the air and vibrating around it will suddenly almost “know” that the resolution date is near and it will “gap up” which we call “jumping the torus”. Look up the Torus on google and twist your brain around that for a bit. That’s a Trader Z thing.

Anyway, here’s an example of what a stock looks like that is coming to a resolution date.

——————————–

IS CARNIVORE FOR REAL?

It occurred to me, from your perspective, you might be wondering is Carnivore is for real. Is this a real group of traders with real skill and pedigree? Or is all of this some kind of manufactured prank of some kind? One Carnivore said that he thought for a while that this might have been a site dreamed up by Cramer himself! Or that CNBC started it.

Carnivore is very real. I promise you. Dutch is a real guy, Trader Z is a real guy, and Swamp Donkey is a real guy. Our newest guy, TBONE, is a real guy. We joke around, we have fun, we prank on Cramer, we talk about using incense and Himalayan salt crystals, rubbing the Infinite Power Glove and the Sacred Geometry Medallion for luck to ward off the evil spirits, and cranking up the volume on great music here on the X-Mansion trading desk. That’s us having fun and, for real, we actually have all those things here at the trading desk and we do use them. When we say we are lighting the Palo Santo, we are. When we say we are cranking up the tunes and we hit you with the video, we are. So that is all real, but it’s also part of keeping things fun and light and not getting too intense about things in a business that can get intense very quickly.

When it comes to making money and the stock picks, we are dead bang serious. That is not a joke. We do not joke around about making money. Extracting money from the market is our life, that’s what we have done for years, and it’s our lives. Like a painter that must paint, we must trade. It’s in our blood.

And when we talk about things like Natural Law and the Law of Vibration, when we talk about a stock being “in the box” and “jumping the torus”, these are all very real to us, and over time, hopefully to you as well. These things – these cornerstones of Carnivores trading methodologies, along with our proprietary Vector Nostradamus and BITE system, these are all very real. Some of what we do is drawn from and has been handed down to us from great traders we learned from and from traders that paved the way long before we were even born. We have extracted from them what we found to be valid and useful and profitable, and we have applied them to Carnivore’s trading. There is nothing fake or phony about it.

As Dutch always says, there is one way to tell if Carnivore is the real deal or not, and that is to look at the trades. He says, “The text messages don’t lie”. When we send out the trade its real time. We can’t lie about it! It goes out and you see it. The stock either goes up or not. We’re either right or not, and we all know it, you know it. We can’t take the trade back and hide it, or fake it, or pretend it didn’t happen. Its time stamped and that doesn’t lie. Which is why, when people early on thought we were crazy (hey – we’re different that’s for sure), they were skeptical and then, after about 1-2 weeks of watching the trades, they were believers. They started trading what we were triggering. And they were making money, real money, in their accounts, and THAT is when things got interesting. We started getting the texts and emails telling us that they thought we were some whacky site that was fund and interesting, but when they saw the results in their accounts, they would suddenly get very serious about Carnivore. Many of them are now Carnivores For Life. Carnivore has changed their lives. They know more about trading than they did when they started, many of them have made more money trading with us than they ever did with a broker or on their own, and they’ve discovered radically great growth companies that we’ve introduced them to that they had never heard of before. They’re trading with clear heads now, they know more than any of their friends about how the market REALLY works, and they’re having more fun than ever with it.